All Categories

Featured

Table of Contents

When life quits, the dispossessed have no choice yet to keep moving. Practically immediately, households have to take care of the challenging logistics of fatality following the loss of a loved one.

Additionally, a full survivor benefit is usually offered unintended death. A changed survivor benefit returns premium usually at 10% passion if death occurs in the first 2 years and entails one of the most kicked back underwriting. The full death advantage is typically offered accidental death. Most sales are carried out in person, and the market fad is to approve a digital or voice trademark, with point-of-sale decisions accumulated and recorded via a laptop or tablet computer.

To finance this company, business rely upon personal health meetings or third-party information such as prescription histories, fraud checks, or motor car records. Underwriting tele-interviews and prescription histories can frequently be used to help the representative finish the application procedure. Historically business depend on telephone interviews to verify or validate disclosure, however a lot more lately to improve client experience, companies are relying upon the third-party information indicated above and providing split second choices at the point of sale without the meeting.

Instant Final Expense Quotes

What is final expense insurance policy, and is it always the ideal path ahead? Below, we take an appearance at how final cost insurance works and variables to consider before you buy it. Technically, final expenditure insurance is a whole life insurance policy policy particularly marketed to cover the costs connected with a funeral, funeral, function, cremation and/or funeral.

However while it is referred to as a policy to cover final expenditures, recipients who get the survivor benefit are not called for to use it to spend for final costs they can utilize it for any kind of purpose they such as. That's since last cost insurance actually comes under the classification of changed entire life insurance policy or simplified problem life insurance policy, which are commonly whole life policies with smaller survivor benefit, commonly in between $2,000 and $20,000.

Our opinions are our own. Burial insurance is a life insurance plan that covers end-of-life expenditures.

Insurance For Burial Expenses

Funeral insurance calls for no medical examination, making it easily accessible to those with clinical conditions. The loss of an enjoyed one is psychological and traumatic. Making funeral preparations and finding a means to pay for them while grieving adds an additional layer of tension. This is where having burial insurance, additionally called final expenditure insurance, is available in convenient.

However, simplified issue life insurance policy needs a wellness assessment. If your wellness standing invalidates you from traditional life insurance policy, funeral insurance policy may be an option. Along with fewer wellness test requirements, burial insurance policy has a quick turn-around time for approvals. You can get insurance coverage within days or also the exact same day you use.

, funeral insurance comes in several forms. This plan is best for those with light to modest wellness conditions, like high blood pressure, diabetic issues, or bronchial asthma. If you do not desire a medical exam but can certify for a streamlined issue plan, it is normally a much better offer than a guaranteed issue plan because you can obtain more insurance coverage for a more affordable premium.

Pre-need insurance policy is high-risk due to the fact that the beneficiary is the funeral home and protection specifies to the picked funeral chapel. Should the funeral home fail or you vacate state, you may not have insurance coverage, which defeats the function of pre-planning. Furthermore, according to the AARP, the Funeral Service Consumers Alliance (FCA) discourages getting pre-need.

Those are essentially burial insurance coverage plans. For guaranteed life insurance, premium computations depend on your age, sex, where you live, and insurance coverage amount.

Funeral insurance policy supplies a simplified application for end-of-life protection. The majority of insurance coverage business require you to speak to an insurance policy agent to use for a policy and acquire a quote.

The objective of having life insurance policy is to alleviate the burden on your liked ones after your loss. If you have a supplemental funeral service plan, your loved ones can make use of the funeral plan to take care of final expenditures and obtain an instant dispensation from your life insurance policy to deal with the mortgage and education and learning expenses.

Individuals that are middle-aged or older with medical conditions might take into consideration interment insurance, as they may not get approved for standard plans with stricter authorization criteria. Furthermore, interment insurance can be handy to those without substantial savings or conventional life insurance coverage. Interment insurance varies from various other kinds of insurance coverage because it uses a lower fatality benefit, normally only adequate to cover expenses for a funeral service and other linked expenses.

Senior Citizens Funeral Insurance

News & World Report. ExperienceAlani has evaluated life insurance policy and pet insurance provider and has written many explainers on traveling insurance, credit, financial obligation, and home insurance policy. She is passionate concerning debunking the complexities of insurance policy and other individual financing subjects to make sure that visitors have the info they need to make the ideal cash decisions.

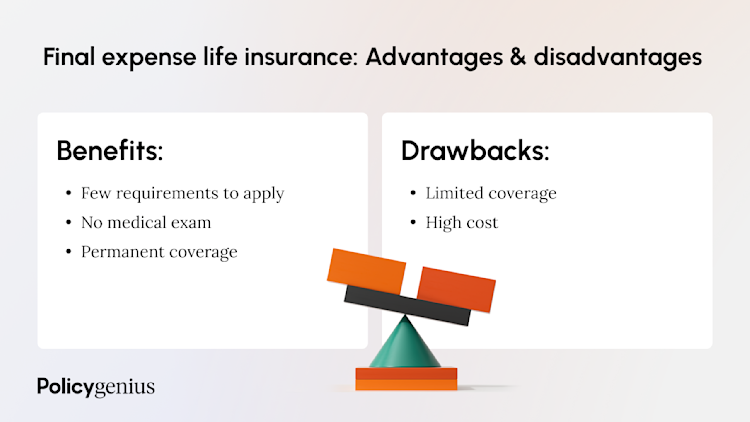

The more coverage you get, the higher your costs will be. Final cost life insurance policy has a number of benefits. Namely, everyone that applies can obtain approved, which is not the instance with various other kinds of life insurance policy. Final expenditure insurance coverage is typically advised for elders who may not get approved for traditional life insurance coverage due to their age.

On top of that, last cost insurance coverage is useful for people that intend to pay for their own funeral. Burial and cremation services can be costly, so final expense insurance policy gives satisfaction knowing that your loved ones will not have to use their savings to pay for your end-of-life setups. Nonetheless, last expense insurance coverage is not the ideal product for every person.

Funeral Policy For Over 80 Years

Getting whole life insurance policy with Values is quick and easy. Insurance coverage is readily available for seniors in between the ages of 66-85, and there's no medical exam needed.

Based on your reactions, you'll see your approximated price and the quantity of protection you certify for (between $1,000-$30,000). You can purchase a plan online, and your protection starts quickly after paying the first premium. Your price never changes, and you are covered for your entire lifetime, if you proceed making the month-to-month repayments.

When you market last cost insurance, you can offer your customers with the peace of mind that comes with knowing they and their households are prepared for the future. Ready to discover whatever you need to recognize to start offering final expense insurance successfully?

Additionally, customers for this type of strategy can have severe lawful or criminal histories. It's essential to keep in mind that various providers use a series of concern ages on their guaranteed problem policies as reduced as age 40 or as high as age 80. Some will also offer higher face worths, as much as $40,000, and others will permit far better death benefit problems by boosting the rate of interest with the return of costs or lessening the variety of years until a full survivor benefit is offered.

Latest Posts

Final Expense Insurance Companies

Life Insurance Burial

Term Life Insurance Instant Online Quote